Understanding Stock Market Volatility and How to Navigate It

October 26, 2023

Stock market volatility is a natural part of investing, but it can be unsettling, especially for new investors. This post explores the causes of volatility, such as economic news, geopolitical events, and investor sentiment. We delve into strategies for managing risk during volatile periods, including diversification, dollar-cost averaging, and maintaining a long-term perspective. Learn how to stay calm and make informed decisions, even when the market seems unpredictable. We also discuss the importance of having a well-defined investment plan and regularly reviewing your portfolio to ensure it aligns with your goals and risk tolerance. Ignoring the noise and focusing on fundamental analysis is key during these times. Understanding market cycles and historical trends can also provide valuable context and help you avoid making emotional decisions. Remember, volatility can also present opportunities for patient investors.

The Beginner's Guide to Real Estate Investing: Building Wealth Through Property

October 20, 2023

Real estate investing offers a unique path to wealth creation, but it can seem daunting for newcomers. This guide breaks down the fundamentals of real estate investing, covering topics such as different types of properties (residential, commercial, land), financing options (mortgages, loans), and investment strategies (buy and hold, flipping, rental properties). We examine the pros and cons of each approach and provide practical tips for finding profitable deals, conducting due diligence, and managing properties effectively. Understanding local market conditions, property values, and rental rates is crucial for success. This post also highlights the importance of building a strong team, including real estate agents, contractors, and property managers. Explore the potential for passive income and long-term appreciation that real estate investing offers. Learn how to leverage your investments and build a diversified portfolio of properties to achieve your financial goals.

Demystifying Cryptocurrency: A Comprehensive Overview for New Investors

October 14, 2023

Cryptocurrency has gained significant attention in recent years, but many people still find it confusing. This post aims to demystify cryptocurrency by explaining the underlying technology (blockchain), different types of cryptocurrencies (Bitcoin, Ethereum, altcoins), and the potential risks and rewards of investing in digital assets. We discuss how to buy, sell, and store cryptocurrencies securely, as well as strategies for managing volatility and diversifying your crypto portfolio. Understanding the regulatory landscape, tax implications, and security best practices is essential. This guide also explores the potential applications of blockchain technology beyond cryptocurrencies, such as supply chain management, healthcare, and voting systems. Stay informed about the latest developments in the crypto space and make informed investment decisions based on your risk tolerance and financial goals. Consider consulting with a financial advisor before investing in cryptocurrencies.

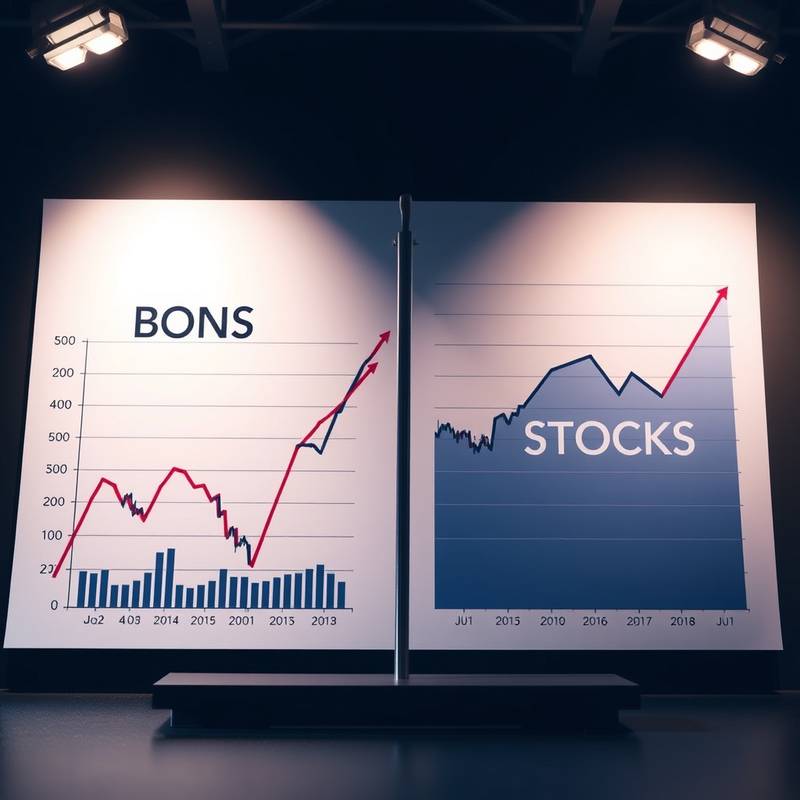

Bonds vs. Stocks: Understanding the Key Differences and Which Is Right for You

October 8, 2023

Bonds and stocks are two fundamental asset classes that play different roles in an investment portfolio. This post compares and contrasts bonds and stocks, highlighting their key differences in terms of risk, return, and volatility. We discuss the types of bonds available (government bonds, corporate bonds, municipal bonds) and the factors that influence their prices. Understanding the relationship between interest rates and bond yields is crucial. We also explore the different types of stocks (large-cap, small-cap, growth stocks, value stocks) and the potential for capital appreciation and dividends. This guide helps you determine which asset class is more suitable for your investment goals, risk tolerance, and time horizon. Diversifying your portfolio with both bonds and stocks can help you achieve a balance between risk and return.

The Importance of Budgeting for Successful Investing: Setting Yourself Up for Financial Freedom

October 2, 2023

Budgeting is the foundation of successful investing. This post emphasizes the importance of creating and maintaining a budget to track your income and expenses, identify areas where you can save money, and allocate funds for investing. We provide practical tips for creating a budget that works for you, including using budgeting apps, setting financial goals, and automating your savings. Understanding your cash flow is essential for making informed investment decisions. This guide also explores the benefits of paying off debt, building an emergency fund, and diversifying your investments. By taking control of your finances and developing good budgeting habits, you can set yourself up for long-term financial success and achieve your investment goals.

About Investing Academy

Investing Academy is dedicated to providing high-quality financial education to individuals of all levels. Our mission is to empower you with the knowledge and skills you need to make informed investment decisions and achieve your financial goals.

Popular Posts

-

Understanding Stock Market Corrections

-

Investing in Sustainable Companies

-

The Power of Compounding

-

Retirement Planning 101